iowa income tax calculator

We keep our database updated with the latest tax brackets each year and aim to be the easiest and most comprehensive income tax resource available on the Internet. The 202223 US Tax Calculator allow you to calculate and estimate your 202223 tax return compare salary packages review salary examples and review tax benefitstax allowances in 202223 based on the 202223 Tax Tables which include the latest Federal income.

Tax Day 2021 See If Your State Has Extended The Deadline For Income Tax Returns The Us Sun

Use our income tax calculator to find out what your take home pay will be in Arizona for the tax year.

. United States Tax Calculator for 202223. Enter your details to estimate your salary after tax. Both long- and short-term capital gains are taxed at the full Iowa income tax rates depending on.

Your average tax rate is 217 and your marginal tax rate is 360. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a.

North Carolinas maximum marginal income tax rate is the 1st highest in the United States ranking directly below North Carolinas. This marginal tax rate means that your immediate additional income will be taxed at this rate. Louisiana state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with LA tax rates of 185 35 and 425 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Your average tax rate is 212 and your marginal tax rate is 396This marginal tax rate means that your immediate additional income will be taxed at this rate. Tax Bracket Tax. For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035.

2022 District of Columbia tax brackets and rates for. These are both a bit above national averages. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

District of Columbia state income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with DC tax rates of 4 6 65 85 925 975 and 1075. Californias maximum marginal income tax rate is the 1st highest in the United States ranking directly. Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee.

This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. Unlike the Federal Income Tax North Carolinas state income tax does not provide couples filing jointly with expanded income tax brackets.

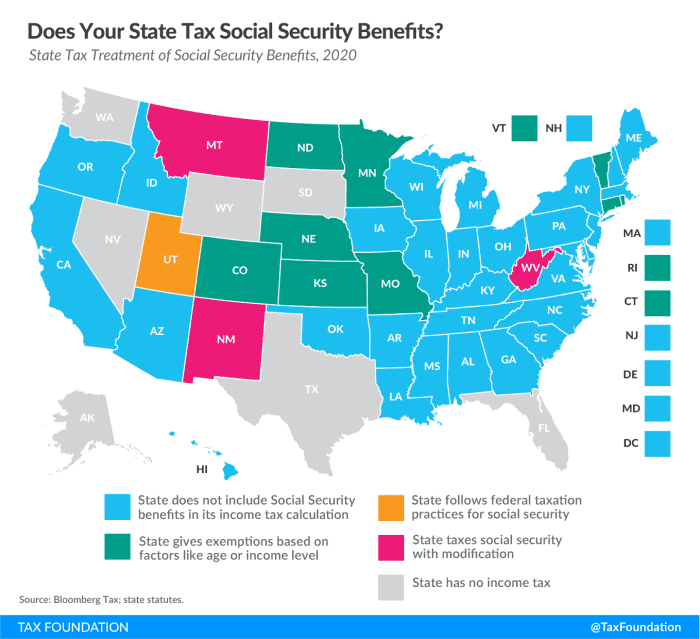

Social Security benefits are exempt from the Iowa state income tax. ASCII characters only characters found on a standard US keyboard. The Iowa Department of Revenue and other state agencies are reminding new and existing users about upcoming changes to GovConnectIowa.

6 to 30 characters long. Your household income location filing status and number of personal exemptions. You can use our free Washington income tax calculator to get a good estimate of what your tax liability will be come April.

GovConnectIowa is the State of Iowas user-friendly self-service portal to register or renew certain business licenses and permits file tax returns and reports make payments and more. Like the Federal Income Tax Californias income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Enter your details to estimate your salary after tax.

Is not a state but it has its own income tax rate. You can use our free Mississippi income tax calculator to get a good estimate of what your tax liability will be come April. Enter household income you received such as wages unemployment interest and dividends.

Use our income tax calculator to find out what your take home pay will be in Kansas for the tax year. Iowa has a cigarette tax of 136 per pack. This marginal tax rate means that your immediate additional income will be taxed at this rate.

How Income Taxes Are Calculated. Must contain at least 4 different symbols. The Washington income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022.

For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035. California collects a state income tax at a maximum marginal tax rate of spread across tax brackets. North Carolina has a 475 statewide sales tax rate but also has 458 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2221 on top of the state tax.

District of Columbias maximum marginal income tax rate is the 1st highest in the United States ranking directly. Iowa - Married Filing Jointly. The Louisiana tax rates decreased from 2 4 and 6 last year to.

Choose the filing status you use when you file your tax return Input the total of your itemized deductions. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer.

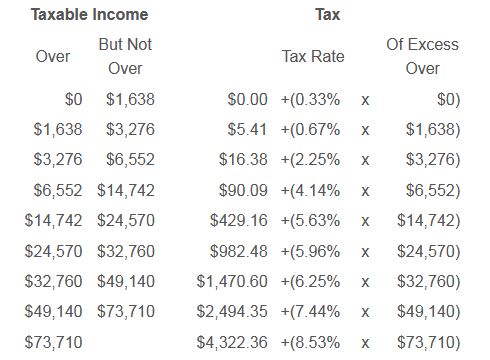

Nine states dont collect individual income tax at all although there may be. For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399. For example Hawaii has a top tax rate of 11 and 12 income brackets while Iowa has a top tax rate of 853 and nine income brackets.

Your average tax rate is 165 and your marginal tax rate is 297. North Carolina collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Louisiana Income Tax Rate 2022 - 2023.

Iowa Capital Gains Tax. Your average tax rate is 165 and your marginal tax rate is 297. Unlike the Federal Income Tax District of Columbias state income tax does not provide couples filing jointly with expanded income tax brackets.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Other forms of retirement income are taxed but seniors are eligible for a deduction of up to 6000 on that income or 12000 if they file jointly. Iowa is moderately tax-friendly.

Is Iowa tax-friendly for retirees. On the next page you will be able to add more details like itemized deductions tax credits capital gains and. Fields notated with are required.

The gas tax in Iowa is 30 cents per gallon of regular fuel and 325 cents per gallon of diesel. Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that varies by income level reaching rates as high as 133 in California. And of course Washington DC.

District of Columbia collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Other states have a top tax rate but not all states have the same number of income brackets leading up to the top rate. On the next page you will be able to add more details like itemized deductions tax credits capital gains.

Use the United States Tax Calculator below. If you make 55000 a year living in the region of California USA you will be taxed 11676That means that your net pay will be 43324 per year or 3610 per month.

Iowa Household Employment Tax And Labor Law Guide Care Com Homepay

Iowa Estate Tax Everything You Need To Know Smartasset

Changes In Sales Use And Excise Taxes In Iowa Uhy

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Iowa Sales Tax Small Business Guide Truic

Tax Withholding For Pensions And Social Security Sensible Money

State Income Tax Rates Highest Lowest 2021 Changes

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Iowa Sales Tax Guide And Calculator 2022 Taxjar

Iowa Farm Income Tax Webinar 2020

Iowa Department Of Revenue Issues Key Guidance On Dpad Like Kind Exchange And 2019 Income Tax Brackets Center For Agricultural Law And Taxation

Iowa Income Tax Calculator Smartasset

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

Calculate Your Transfer Fee Credit Iowa Tax And Tags

State Sales Tax Rates Sales Tax Institute

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management